Practical Financial Literacy Program for Kids

Financial habits form young. Youth who are not taught how to

manage, value, and work for money lack the skills they need to be

self-sufficient. This situation has impact not only on the child’s future

finances, but also self-esteem, relationships, and overall enjoyment of

life when he or she matures into adulthood.

What is this course?

This course teaches practical financial concepts and helps children develop a comprehensive understanding of how money works in our world. Children will learn through simulation games of market and economy, simulating interest rates, inflation rates and supply-demand economics in a simple game format. This course will provide the right financial education for children and will inculcate the importance of “saving money” and “growing one’s money” to lead a healthy financial

life. Detailed curriculum is mentioned below

Course Duration: 15 classes | Gamified Learning | Built by Ivy League MBAs "

Book A Free Class For Your Child

Real-world, non-bookish, necessary applicative learning that can be absorbed by kids easily and remembered forever.

Simulation and Gamification based learning of various variables and market/economic behaviour for easy internalization for children.

Simulation and Gamification based learning of various variables and market/economic behaviour for easy internalization for children.

Learning Extensions Assessments Lesson applications Homework Activities Mini-Projects

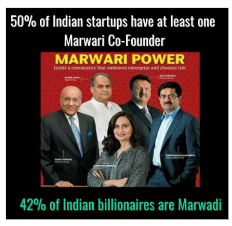

A lesson from the Marwari Community of India on why teaching kids about finance early is important

In the Marwari community of India, even when the family is financially very well-doing, Marwari households generally start teaching their children the importance of money at a young age. They encourage their children to begin saving as soon as they reach the age of early teens by telling personal anecdotes from their own lives or by giving them financial advice.

You’ll see most Marwari children already managing personal finances during college/pre-university time and taking positions of college financier, managing group finances, etc by doing ledger financing and being highly aware of money between the ages of 13-17 itself, which many normal people might not be aware of until their 30s too.

The point is – Teaching kids finance is never early. Obviously, we’re not running them through balance sheets and accounting and making them go through exams.

You’ll see most Marwari children already managing personal finances during college/pre-university time and taking positions of college financier, managing group finances, etc by doing ledger financing and being highly aware of money between the ages of 13-17 itself, which many normal people might not be aware of until their 30s too.

The point is – Teaching kids finance is never early. Obviously, we’re not running them through balance sheets and accounting and making them go through exams.

What happens when kids learn about finance early?

When children/teenagers learn about finance early, they’re still not absorbing it completely. But with

this knowledge, they will start observing the increase of prices, absorbing the changes in the world

in interest rates and understand that money mechanics of the world. They’ll internalize that one

shouldn’t waste money on unnecessary stuff. This enables them to save their money early when

they start working and they’ll have a more secure financial future in their working lives compared to

their peers.

A majority of the most famous Indian businessmen, billionaires, startup founders and stock market gurus come from the Marwari community and that is not a coincidence. They have the good habits of teaching finance and the importance of money very early in their community

A majority of the most famous Indian businessmen, billionaires, startup founders and stock market gurus come from the Marwari community and that is not a coincidence. They have the good habits of teaching finance and the importance of money very early in their community

- Lesson 1: The Basic Mathematics of Absolutes, Growth Rates & Rate of Change

- Lesson 2: Simple Interest and Compound Interest - Everybody in this world is either paying interest or earning interest. Credit Cards or Loans means you’ve to pay interest

- Lesson 3: Earnings, Spendings and Savings

- Lesson 4: Purchasing Power of Money Why does the power of money change? What is Inflation - how does your purchasing power keeps reducing? Demand led inflation, Supply led inflation, Central bank policy led inflation

- Lesson 5: How low interest rate causes inflation and cripples the economy? How even a high interest rate will cripple the economy? It is about the rate of change, not about high or low. Overall economic value and rate of growth

- Lesson 6: UnicMinds Simulation Game - 1: demand and supply (teacher led)

- Lesson 7: UnicMinds Simulation Game - 2: markets, banks,interest rate and inflation (teacher led)

- Lesson 8: UnicMinds Simulation Game - 3: economy, gdp, and overall mechanics (teacher led)

- Lesson 9: Why is saving money really important? Time value of Money

- Lesson 10: Basics of Debt & Equity in a children game

- Lesson 11: Creditors and Debtors

- Lesson 12: Understanding types of banks & different types of bank accounts; How do banks make money?

- Lesson 13: Predicting Future Prices of Common Goods in various countries

- Lesson 14: Preparing Ledger Account of your Piggy Bank Account

- Lesson 15: Currencies, Currency Exchanges, and the Foreign Exchange Market

- Summary of Money Lessons

- *For children younger than 10 years, the above curriculum is restricted to 10 classes covering the important basics with less mathematics.